Understanding Variances in Intuitive Code's Analytics Dataset

This article provides an essential overview of the factors influencing the variations in parameter values across different Intuitive Code analytics datasets, helping users choose the most suitable dataset for their investment needs.

Oracle AI vs. Intuitive One

Intuitive Code’s Oracle AI and Intuitive One packages serve as foundational datasets with specific focuses and analytics capabilities:

Oracle AI: This package features a dataset called Standard Analytics, which offers comprehensive midterm analysis. This makes it a solid choice for users with a medium-term investment horizon. The dataset can be used for short-term trading, but it's less effective than advanced solutions.

Intuitive One: Users of the Intuitive One package access advanced analytics for more precise insights, also centered on midterm analysis. Though optimized for midterm use, this dataset offers more depth than Oracle AI, making it an ideal choice for users requiring more refined parameters. Like Oracle AI, it may be used for short-term trading but is best suited for midterm strategies.

Note: Short-term and long-term analyses are not included in these datasets. For a more effective short-term solution, Quantum Leap AI is recommended.

Intuitive One vs. QMI AI

When comparing Intuitive One and QMI AI, it’s essential to recognize that both products offer advanced analytics datasets, yet they are geared toward distinct investment timeframes:

QMI AI: Designed with a mid-to-long-term focus, QMI AI provides users with analytics optimized for those planning to hold positions longer. Consequently, parameter values in QMI AI might vary from Intuitive One for the same stock, reflecting its longer-term analysis perspective.

Intuitive One: With its primary focus on midterm analysis, this dataset is tailored for investors with a moderate timeframe outlook.

When a stock appears in both products, users are encouraged to select the dataset that aligns with their specific investment profile. QMI AI is generally more suitable for those with mid-to-long-term strategies, whereas Intuitive One caters to midterm needs.

Highly Volatile Stocks: Quantum Leap AI

While all Intuitive Code products can process highly volatile stocks, Quantum Leap AI offers a distinct advantage in terms of efficiency. Equipped with live-streaming data and live analytics dashboards, Quantum Leap AI delivers real-time updates and deeper insights, making it the optimal choice for handling high-volatility environments. Users focusing on rapid, high-frequency trading or highly volatile markets will find this solution exceptionally effective.

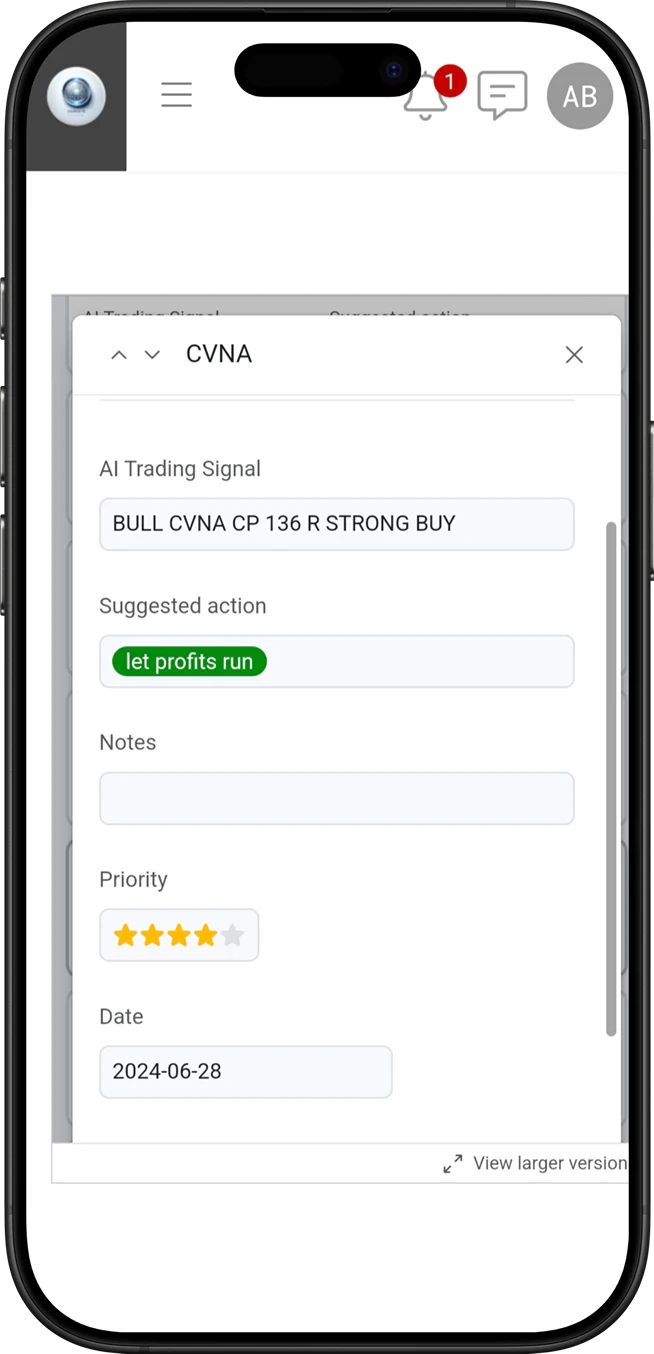

AI Signals vs. Analytics

There may be instances where an AI signal notifies you of a change in a stock parameter (e.g., SP, RP, PT, R, BCS, WCS, TS, LD) before this update is reflected in the AI agent you’re querying:

In these cases, the AI signal holds higher priority and is more immediate than the current dataset within the AI analytics agent.

This priority condition remains active until the analytics dataset in the AI agent is updated to reflect the new parameter changes.

AI signals thus provide users with an early edge, ensuring timely actions based on the latest insights.

This guide provides a thorough understanding of each dataset’s application, from midterm to high-volatility environments. By matching your investment approach with the appropriate dataset, you can optimize your use of Intuitive Code’s tools for more informed, confident decision-making.