The Kasparov Move: Achieving Winning Consistency with Intuitive Code’s AI Algorithm

The Kasparov Move—a four-phase strategy of STOP, FOCUS, SEE, PLAY

The Kasparov Move—a four-phase strategy of STOP, FOCUS, SEE, PLAY—is designed to help traders achieve consistent success. Originally inspired by the strategic depth of chess, this method was adapted to investment and trading strategies by Alex Vieira, founder of Intuitive Code. Through this unique adaptation, it forms the foundation of Intuitive Code’s Quantum AI algorithm, engineered to reach 100% proven accuracy by systematically guiding users through each strategic step.

This article outlines each phase, explaining how these steps contribute to trading success and how they are embedded in Intuitive Code’s AI-driven approach.

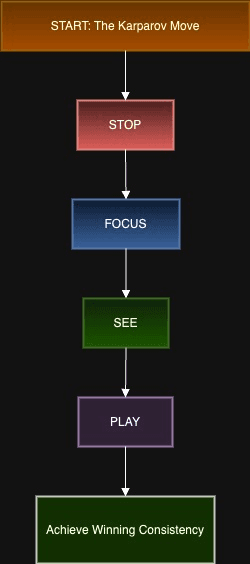

Flowchart representing "The Karparov Move" phases

Explanation of the Colors:

START: Represents the beginning of The Karparov Move.

STOP: Symbolizes the importance of halting before analysis.

FOCUS: Denotes clarity and attention to relevant data.

SEE: Emphasizes gaining a full view of potential outcomes.

PLAY: Indicates the action and execution phases.

Achieve Winning Consistency: Highlights the ultimate goal of applying this process.

Phase 1: STOP

The STOP phase is where traders pause before taking any action. This essential first step acts as a critical checkpoint, allowing traders to assess the environment and mitigate potential risks before moving forward. In this phase, traders:

Evaluate Current Market Conditions: Take stock of recent market developments, noting any indicators of volatility, abnormal trading patterns, or economic events that could impact positions.

Assess Recent Signals and Alerts: Review any relevant updates, signals, or alerts generated by Intuitive Code’s AI to understand current asset performance and identify any need for caution.

Pause Impulsive Reactions: This phase is designed to prevent knee-jerk decisions in response to sudden market fluctuations, creating space for thoughtful, strategic planning.

To further reinforce the importance of stopping and assessing risk before acting, we recommend the following articles:

Algorithm to Prevent Losses from Short Squeezes and Share Price Manipulation This guide provides an algorithm for identifying and avoiding high-risk situations such as short squeezes and share price manipulation. Following this algorithm helps traders recognize potential traps and avert substantial losses.

Effective Intuitive Code AI Tools to Manage Stop Losses In this article, traders can learn how to use Intuitive Code’s AI-driven stop-loss tools to minimize risk effectively. These tools enable traders to set data-backed stop-loss levels that adjust dynamically, helping preserve gains and prevent significant losses.

Earnings Participation Rules: Risk Management Guidelines This resource outlines participation rules for earnings events, providing essential risk management guidelines tailored to both non-professional and professional users. By adhering to these rules, traders can mitigate risk associated with earnings announcements and other high-impact events.

By stopping first, traders ground themselves, prevent impulsive decisions, and create space for strategic thinking. This step is fundamental in Intuitive Code’s algorithm, which initially halts any automated actions until optimal trading conditions are confirmed.

These articles are crucial for implementing the STOP phase effectively. They provide additional tools and strategies to help traders pause, assess, and avoid unnecessary risks before moving into the next phases of The Kasparov Move.

Phase 2: FOCUS

In the FOCUS phase, attention is directed exclusively toward relevant data and signals to make a well-informed decision. This stage is critical for clarifying your trading approach and aligning it with Intuitive Code’s AI-driven insights. During this phase, the trader:

Prioritizes Key Analytics: Focus on AI-generated data points, including risk indicators, target price levels, and proprietary metrics that align with strategic goals.

Filters Out Market Noise: By disregarding irrelevant data, you maintain clarity on actionable signals and reduce distractions, allowing the core data to guide your strategy.

Sets the Strategic Direction: Based on the insights gathered, the trader chooses an optimal approach, tailored to both the market context and personal investment goals.

To help users further refine their portfolio and gain clarity in this phase, we recommend reviewing the following articles:

Algorithm to Select Your Portfolio Based on Stock Risk Profile and Uniqueness This guide offers a step-by-step process for selecting stocks based on their risk profile and unique value. By understanding the unique strengths and risk levels of each stock, traders can focus on those that best align with their objectives and investment tolerance.

Algorithm to Select Your Portfolio Based on Intuitive Code AI Analytics This article delves into selecting stocks using Intuitive Code’s advanced AI analytics, which helps users identify high-potential assets based on AI-driven data. This ensures that each portfolio selection is backed by precise, data-driven insights for optimized performance.

These resources will help you make better-informed decisions during the FOCUS phase by integrating both traditional risk assessments and advanced AI analytics into your portfolio selection.

Phase 3: SEE

The SEE phase is about gaining comprehensive visibility over the full picture of the market or asset in question. In this stage, the trader prepares for a well-rounded perspective on potential outcomes, equipping them to anticipate and respond to market changes effectively. In this phase, the trader:

Examines Potential Outcomes: Considers various scenarios, including best-case and worst-case projections, as well as support and resistance levels. This approach ensures the trader is prepared for multiple contingencies.

Considers Alternative Perspectives: Looks at the situation from different angles, taking into account various analytical viewpoints and potential directions the market might take.

Prepares for Contingencies: Develops strategies for different scenarios, including proactive steps to take if the market shifts unexpectedly.

To further enhance analytical depth and provide a structured approach to market visibility, we recommend the following resources:

Perelman's Confidence This article covers Perelman's Confidence, a framework that enables traders to assess the confidence level of their positions and analytics. By applying this framework, traders can identify which trades align best with their confidence metrics, providing an additional layer of clarity in decision-making.

Perelman's Stability Analysis Parameters in Intuitive Code's AI Analytics This resource explains how Perelman's Stability Analysis Parameters are integrated into Intuitive Code's AI analytics. These parameters help traders assess the stability of their positions over time, offering insights into the likelihood of sustained performance and minimizing the risk of unexpected volatility.

Getting Started Manual for Intuitive Code's Real-time AI Analytics Dashboard The real-time AI analytics dashboard offers up-to-the-minute data, allowing traders to monitor intraday changes and respond to market shifts with precision. This manual provides guidance on using the dashboard to see real-time analytics and recognize when market conditions are evolving.

These resources will empower you to make informed, multi-dimensional evaluations during the SEE phase. By understanding confidence levels, stability metrics, and real-time analytics, traders gain a clearer, more comprehensive view of potential scenarios, allowing them to navigate markets with confidence and accuracy.

Intuitive Code’s Quantum AI employs this SEE phase by analyzing all dimensions of the stock, providing traders with both directional forecasts and underlying reasons, enabling traders to make comprehensive, foresighted decisions.

Phase 4: PLAY

The PLAY phase is the final stage, where traders put their strategic decisions into action. This phase involves executing calculated moves with precision and continuously adapting to real-time market shifts. In this phase, traders:

Execute the Chosen Strategy: Implement actions based on insights from the previous phases, using data-driven decisions to enter or adjust positions.

Monitor and Adjust: Continuously track the trade’s performance, making real-time adjustments as market conditions evolve. Staying informed allows traders to optimize outcomes and minimize risk.

Review and Learn: After the trade execution, evaluate the results and identify any improvements for future strategies.

To ensure effective execution and maximize the benefits of AI-driven insights, we recommend referring to the following resources:

AI Trading Signals: Your Guide to High-Precision Trading This guide offers an in-depth understanding of Intuitive Code’s AI Trading Signals, which provide actionable insights with high precision. Following these signals helps traders align with optimal entry and exit points and maintain accuracy in their trades.

Understanding Signal Variations Across Intuitive Code's AI Products This article explains the variations in AI trading signals across different Intuitive Code products, allowing traders to interpret signals accurately based on their context. Understanding these differences enables traders to make better-informed decisions and leverage the specific advantages of each AI product.

Getting Started Manual for Intuitive Code's Quantum AI Trading and Analysis This manual provides comprehensive guidance on using Intuitive Code’s Quantum AI trading platform. It covers key features, strategies, and AI tools available in Quantum AI, helping traders optimize their actions during the PLAY phase.

These resources support effective trade execution by providing clarity on AI trading signals, signal variations across Intuitive Code products, and the functionalities within the Quantum AI platform. Together, they empower traders to execute confidently, adapt dynamically, and maximize their trading outcomes in the PLAY phase.

The Quantum AI algorithm activates actions in this PLAY phase, ensuring that the strategy is executed with precision and adjusts in real-time to reflect market changes, maximizing consistency and accuracy.

The Kasparov Move: use case in Strategic Investing

This article provides a practical use case to illustrate how each phase of The Kasparov Move—STOP, FOCUS, SEE, and PLAY—can be applied to strategic investing. By walking through an example involving a volatile stock, you’ll see how this methodology guides each step, transforming complex decisions into manageable, structured actions.

Summary: The Power of the Kasparov Move in Achieving Accuracy

The Kasparov Move—STOP, FOCUS, SEE, PLAY—serves as the foundation for Intuitive Code’s Quantum AI algorithm, creating a disciplined approach to trading. This method, adapted to the financial world by Alex Vieira, allows traders to achieve consistent success by transforming market analysis into precise, actionable insights. Through each phase, Intuitive Code’s AI systematically guides users, providing a robust framework that maintains 100% accuracy and delivering a distinct edge in complex market environments.

By following the Kasparov Move, traders can achieve disciplined, confident trading, reinforcing their potential to make data-driven, winning decisions.