Real-time Smart Fraud Detection: Revolutionizing Risk Management with AI

Real-time Smart Fraud Detection: Enabling Intelligent Decision Making

Introduction

In the dynamic world of financial markets, the ability to detect and respond to fraudulent activities in real time is paramount. Intuitive Code’s exclusive Real-time Smart Fraud Detection technology provides investors and institutions with a cutting-edge solution to identify fraud before it impacts portfolios. By leveraging advanced AI algorithms, this technology ensures intelligent decision-making while safeguarding investments.

Key Features of Real-time Smart Fraud Detection

1. Advanced AI Algorithms

Our technology uses state-of-the-art AI models to analyze vast datasets in real time. These algorithms:

Detect irregularities and anomalies indicative of fraud.

Continuously learn from new data to adapt to emerging fraud patterns.

Provide actionable insights to enable preemptive measures.

2. Comprehensive Risk Profiling

Smart Fraud Detection creates detailed risk profiles for entities, assets, and transactions by:

Evaluating historical data against current activities.

Integrating analytics from diverse sources, including market movements, news, and behavioral patterns.

Assigning fraud risk scores to prioritize areas needing immediate attention.

3. Real-time Alerts

Investors and institutions receive instantaneous notifications about potential fraud risks. This feature:

Ensures timely interventions.

Reduces exposure to high-risk assets or transactions.

Supports decision-making with up-to-date fraud intelligence.

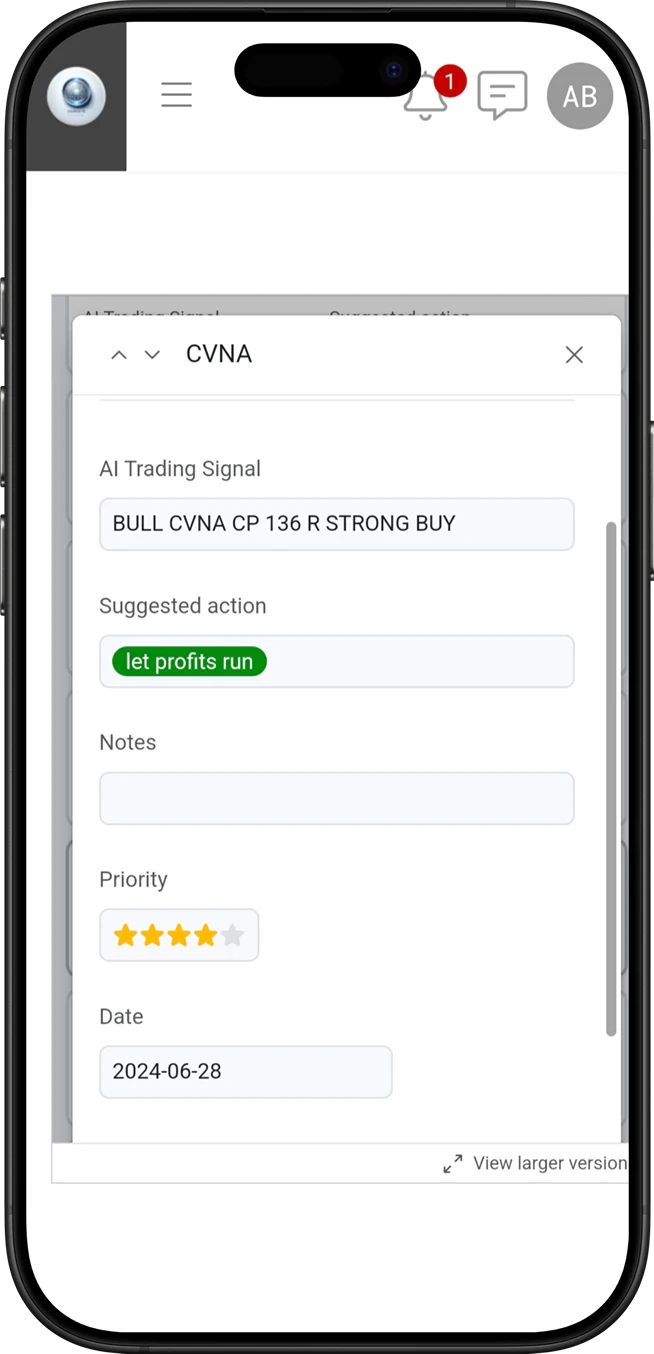

4. Integration with Intuitive Code’s Analytics Ecosystem

The technology seamlessly integrates with Intuitive Code’s broader suite of AI solutions, enabling:

Holistic risk management by linking fraud detection with trading signals and portfolio analytics.

Enhanced decision-making through cross-referencing fraud insights with market trends and AI-driven forecasts.

How Smart Fraud Detection Works

Step 1: Data Aggregation

The system collects data from multiple sources, including:

Market transactions.

Behavioral analytics.

External reports and news articles.

Step 2: Pattern Recognition

AI algorithms analyze the aggregated data to identify:

Unusual patterns or transactions.

Behavioral deviations that suggest fraudulent activity.

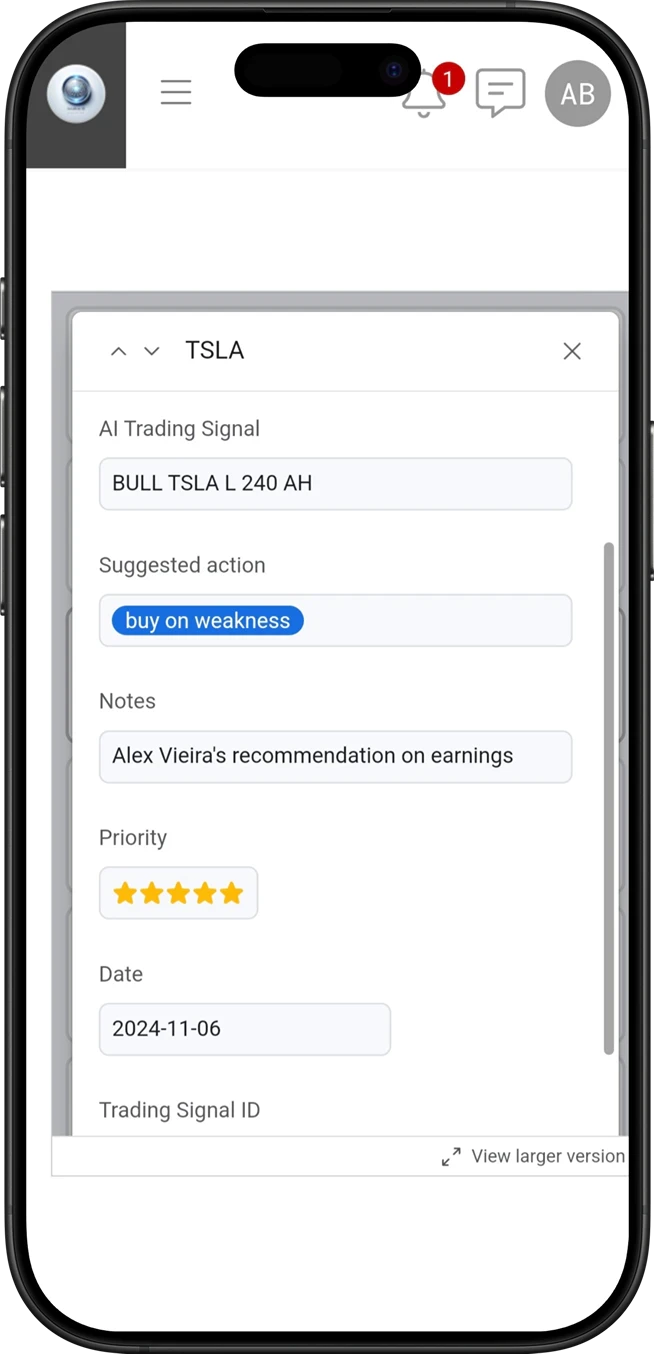

Step 3: Risk Scoring and Alerts

Based on identified patterns, the system:

Assigns a fraud risk score to assets, entities, or transactions.

Sends real-time alerts to users with actionable recommendations.

Watch It in Action

See how Real-time Smart Fraud Detection identifies anomalies and issues real-time alerts to prevent potential losses.

Step 4: Continuous Learning

The AI models continuously update and refine their fraud detection capabilities by:

Learning from flagged incidents.

Incorporating new data and evolving fraud methodologies.

Benefits of Real-time Smart Fraud Detection

1. Enhanced Security

Protect portfolios from potential fraud risks by identifying and addressing threats proactively.

2. Intelligent Decision Making

Leverage fraud insights to make smarter investment decisions, minimizing exposure to high-risk scenarios.

3. Improved Efficiency

Automated fraud detection reduces the need for manual intervention, saving time and resources.

4. Competitive Advantage

Stay ahead of the curve by integrating fraud detection insights into broader trading and investment strategies.

Real-world Applications

1. Protecting Against Corporate Misconduct

Identify fraudulent financial reporting or insider trading that could negatively impact stock performance.

2. Safeguarding High-Risk Assets

Detect red flags in assets prone to erratic patterns or lacking transparency.

3. Supporting Regulatory Compliance

Help institutions comply with regulatory standards by ensuring transactions meet fraud detection criteria.

Why Intuitive Code’s Smart Fraud Detection Stands Out

Unmatched Accuracy: Combines cutting-edge AI with years of financial expertise.

Real-time Insights: Provides fraud alerts as they happen, enabling immediate action.

Seamless Integration: Works in tandem with other Intuitive Code solutions for a comprehensive investment strategy.

Customizable Features: Tailor fraud detection parameters to specific needs and risk appetites.

Conclusion

Intuitive Code’s Real-time Smart Fraud Detection technology empowers investors with unparalleled tools to identify and mitigate fraud risks effectively. By combining advanced AI, real-time analytics, and seamless integration with our broader ecosystem, this technology redefines risk management in financial markets. Explore more about this groundbreaking solution and its applications at Intuitive Code’s Strategic Insights.