Intuitive Code: User Guidelines and Best Practices for AI Signals

Intuitive Code: Principles and Best Practices

1. Algorithmic Trading Rules

Acting Promptly on Signals

It is the user’s responsibility to act on signals promptly when issued. For instance, if the algorithm provides a buy signal at $110 and the user disregards it, then attempting to buy later at $110 or higher violates core principles. Similarly, on the short side, ignoring a short signal at $110 and later attempting to short at $90 or lower goes against the disciplined trading framework established by Intuitive Code. Chasing signals or acting late undermines the precision and effectiveness of the AI system.

Practical Example

Imagine the algorithm issues a buy signal at $100. If the goal is to acquire a significant position, another buy signal might appear at $105. However, if the primary objective has been met, no further buy signals will be issued at higher prices. Similarly, if a short signal is issued at $100, it will not be repeated at much lower prices unless specific criteria justify the action.

Buy and Short Signal Rules

When the algorithm issues a buy signal at a price , it is important to understand that this signal will not necessarily be repeated at unless the primary goal is to acquire a significant position. This ensures that the focus remains on strategic accumulation rather than redundant signals. Similarly, for short positions, a short signal issued at will not be repeated at , maintaining precision and avoiding unnecessary duplication of actions.

Responsibility to Act Swiftly

Users must act on signals promptly to adhere to Intuitive Code's disciplined trading framework. Ignoring a buy signal at X and later attempting to buy at X+Y, or disregarding a short signal at X and then shorting at X-Y, violates these core principles. Such delays undermine the effectiveness of the AI system and diminish the competitive advantage provided by actionable insights.

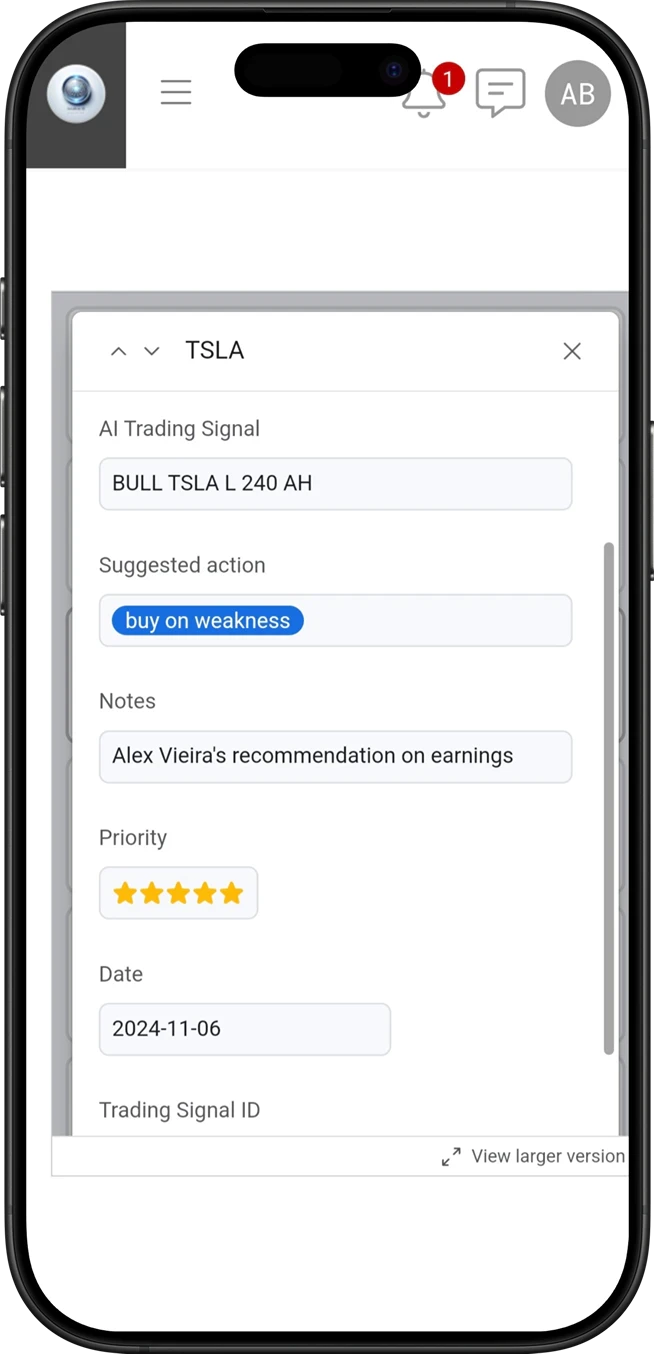

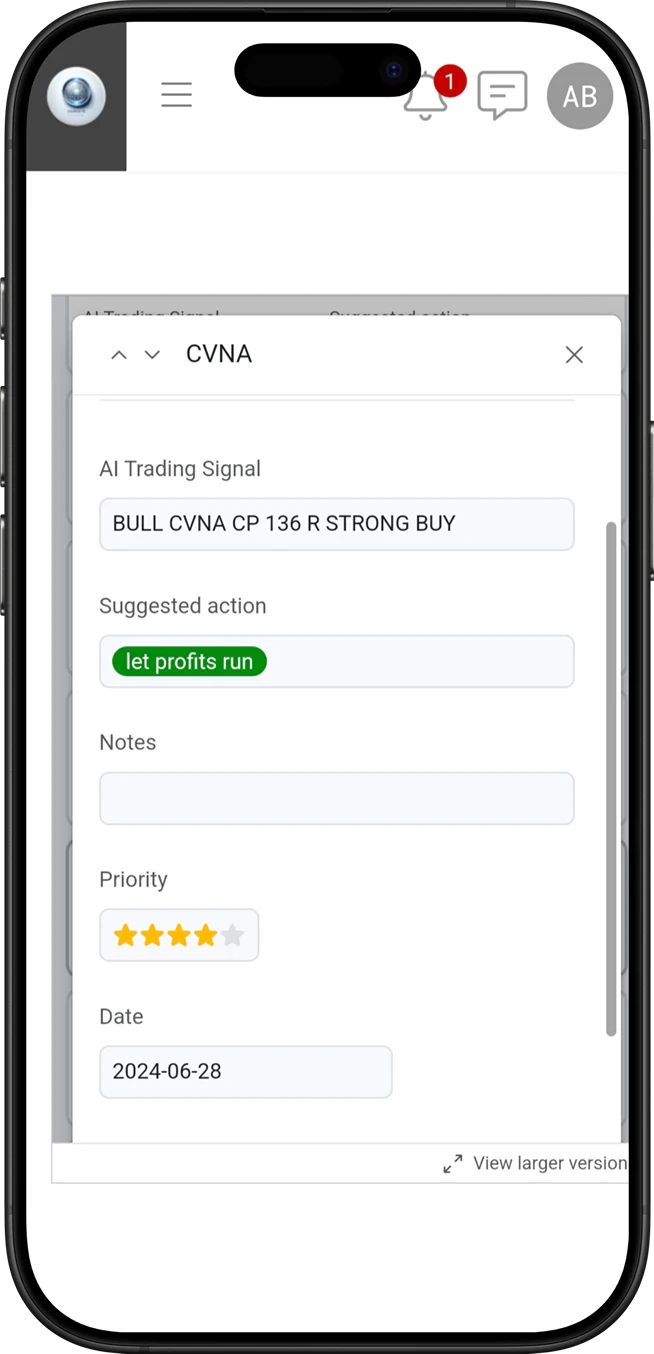

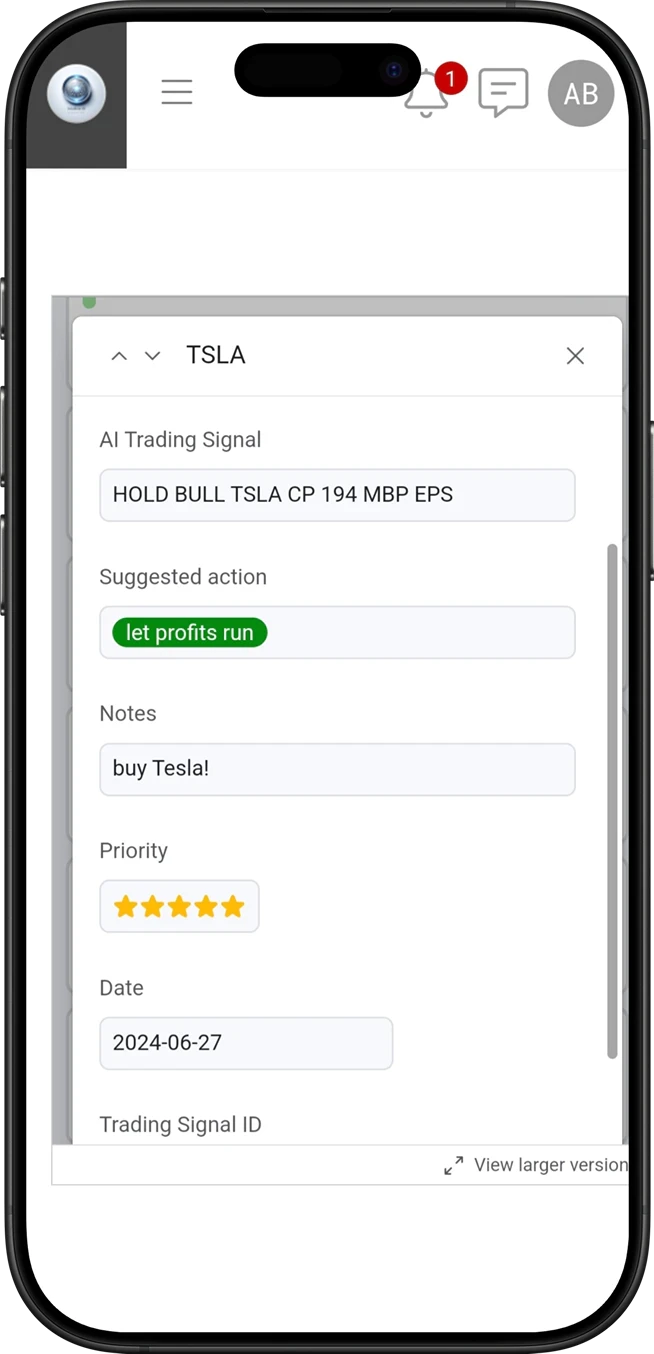

2. Types of AI Signals

Analytics vs. Trading Signals

An AI signal can serve two primary purposes:

Update on Analytics: These signals provide updates or refined insights into the stock’s metrics, trends, or other analytical data.

AI Trading Signals: These signals include specific actionable recommendations or codes for executing trades, helping users make informed decisions.

3. Actionable AI Signals

Precision and Real-Time Value

Actionable AI signals are highly valuable as they include both suggested actions and precise real-time pricing. Examples include:

MTS (Move Trailing Stop): Adjust the trailing stop to secure profits.

PRP (Protect Remaining Positions): Safeguard the remaining portion of an investment.

PTS (Place Trailing Stop): Introduce a trailing stop to limit losses or secure gains.

Timeliness and Expiry

These signals are most effective when acted upon promptly. Market conditions can change rapidly, so adhering to real-time recommendations ensures optimal outcomes. For instance, an MTS signal issued during a volatile trading session may no longer be effective if delayed.

Precision and Real-Time Value

Actionable AI signals are highly valuable as they include both suggested actions and precise real-time pricing. Examples include:

MTS (Move Trailing Stop): Adjust the trailing stop to secure profits.

PRP (Protect Remaining Positions): Safeguard the remaining portion of an investment.

PTS (Place Trailing Stop): Introduce a trailing stop to limit losses or secure gains.

These signals are designed to provide clarity and precision, ensuring users can act decisively in fast-moving markets.

4. Position Sizing Guidelines

Guidelines and Advisory

Codes related to position sizing, while useful, are intended to serve as general guidelines. Users must exercise caution and consult with a licensed financial advisor before employing leverage or taking positions based solely on these codes. For instance, a position sizing code suggesting a 10% portfolio allocation should be evaluated against the user’s risk tolerance and financial objectives.

Practical Example

If the AI issues a code recommending a leveraged position, users must calculate the potential risk and align it with their individual investment strategy. For example, a leverage ratio of 2:1 may amplify returns but also increase exposure to losses.

Guidelines and Advisory

Codes related to position sizing, while useful, are intended to serve as general guidelines. Users must exercise caution and consult with a licensed financial advisor before employing leverage or taking positions based solely on these codes. This ensures that individual financial circumstances and risk tolerances are appropriately considered.

5. Access to AI Signals

Acting Without Waiting for AI Trading Signals

Users are not required to wait for an AI trading signal to act. Decisions can be based on the existing analytics datasets provided by Intuitive Code. For instance, once the algorithm executes an order and releases an AI trading signal, it can continue executing trades indefinitely according to the existing analytics dataset without communicating every single trade. Similarly, users can act independently based on these datasets. This approach prevents unnecessary clutter, ensuring that only the most critical signals appear on dashboards, helping users focus on what matters most.

Reference to Related Knowledge Base Articles

To better understand how signal variations impact outcomes across different Intuitive Code AI products, refer to Understanding Signal Variations Across Intuitive Code’s AI Products. This article explains how datasets, signal precision, and other factors influence results. For additional insights into how high-precision AI trading signals work, explore AI Trading Signals: Your Guide to High-Precision Trading.

License-Based Accessibility

Users’ access to AI signals for trading and analytics is contingent upon an active license. The following rules govern signal access:

Log History: Users can access a comprehensive log history through their Microsoft Teams channel. This provides a reliable record of past signals and actions issued since the start of their active plan, enabling them to review historical performance and refine their strategies.

Recent Signals in the App: Within the app, users have access to the most recent signals from the past week, ensuring up-to-date information for decision-making.

Transparency and Compliance

Intuitive Code adheres to global financial compliance standards, but its commitment to transparency goes far beyond industry norms. The unique aspect of Intuitive Code’s transparency lies in providing users with access to a comprehensive log record of trading signals. This log constitutes undeniable proof of the source and validity of every AI trading signal, distinguishing Intuitive Code from competitors.

Proof of Source and Reliability

While others may obscure their processes, Intuitive Code’s log history ensures complete accountability. Users can verify past signals and actions, reinforcing trust in the system and its insights. This unparalleled transparency enables users to make informed, confident decisions based on a clear and traceable record of data.

License-Based Accessibility

Users’ access to AI signals for trading and analytics is contingent upon an active license. The following rules govern signal access:

Log History: Users can access a comprehensive log history through their Microsoft Teams channel. This provides a reliable record of past signals and actions.

Recent Signals in the App: Within the app, users have access to the most recent signals from the past week, ensuring up-to-date information for decision-making.

6. After-Hours & Overnight Trading Signals

Included in High-End Plans

After-hours and overnight trading signals are exclusive to Intuitive Code’s high-end plans, offering users a significant competitive advantage. These signals provide critical insights outside of standard trading hours, enabling users to:

Acquire positions with a distinct edge in volatile or fast-moving markets.

Limit potential losses by acting swiftly on updated analytics or trading recommendations.

Responsibility to Act Swiftly

While these signals enhance decision-making, their availability should not excuse users from acting promptly on regular trading signals. The ability to act decisively during standard trading hours remains crucial for securing competitive advantages or mitigating risks.

Competitive Advantage

Users with access to after-hours and overnight signals enjoy a superior edge compared to other products, ensuring they are always one step ahead in anticipating market movements and capturing opportunities.

Unlocking the Power of Intuitive Code

Adherence to these principles and best practices ensures that users of Intuitive Code’s solutions operate within a framework that prioritizes precision, reliability, and informed decision-making. By understanding and following these rules, users can maximize the value of Intuitive Code’s AI-driven insights while maintaining financial prudence.